The Repossession Process and How Bankruptcy Can Help Brock & Stout Attorneys at Law

In many states, this gives you around 10 to 15 days to reclaim it - if you can afford it. Getting your car back after repossession means taking one of the following actions: Redeem your vehicle: To do this, pay the entire balance of your loan including all fees and charges incurred during repo.

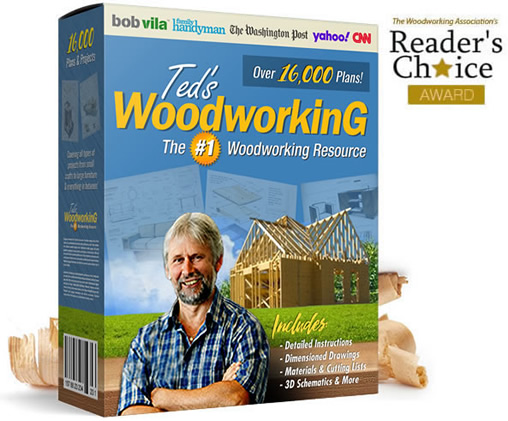

Loan Defaults and Repossessions Returned to Historical Norms in 2022 Cox Automotive Inc.

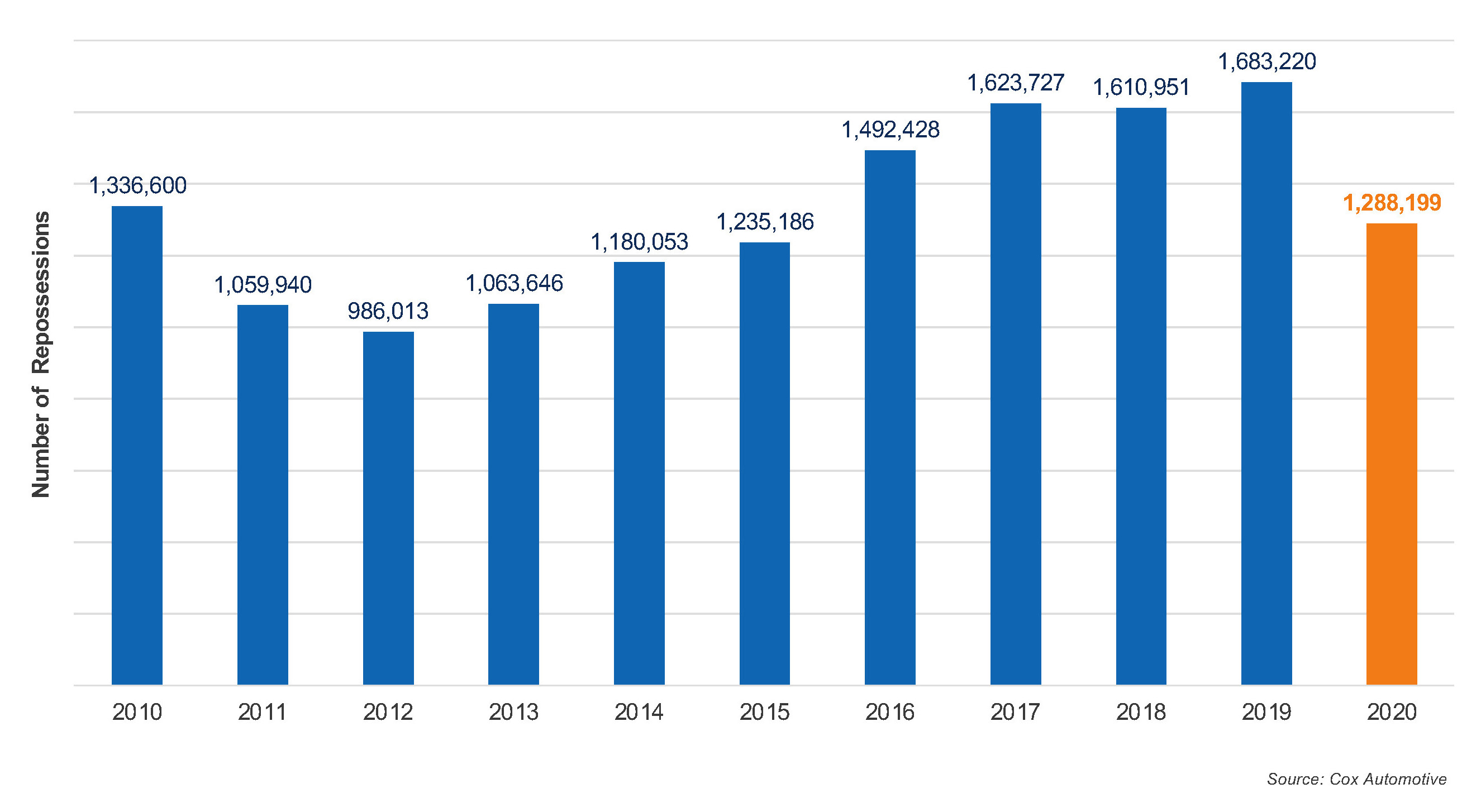

Car repossessions have grown less common for the last two years, but those days may be over. Credit rating agency Fitch Ratings says repossession rates have nearly returned to pre-pandemic levels.

Vehicle Repossession in Bankruptcy Amourgis & Associates, Attorneys at Law

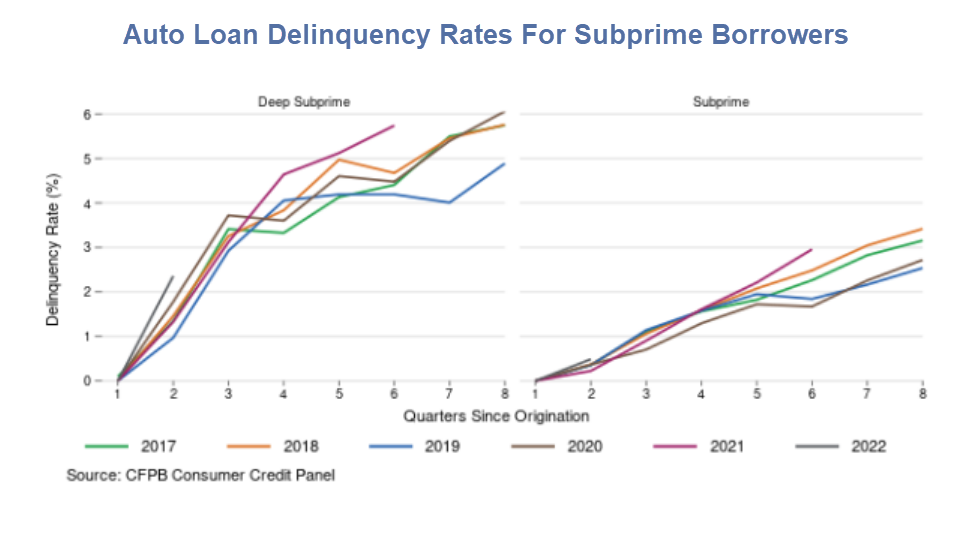

The share of subprime borrowers who were "delinquent"—that is, at least 60 days late on their car payments—rose to 6.11% in September, up from 5.01% just three months earlier, according to.

Recover from Car Repossession Phoenix Fresh Start

Higher car repossession rates also kept charge-offs lower, with the company achieving 28.5% for the past quarter versus 27.1% a year ago and 26.6% two years ago. Judy also noted the company's frequency of losses increased in the last quarter. She attributed that to "normalization after the unsustainable historic lows resulting from stimulus.

How Does a Repossession Affect Your Credit?

After auto repossessions tumbled during the pandemic, they are now approaching their pre-pandemic levels with industry analysts worried the trend will continue.. Still, the rate of defaults and.

Auto Repossession facts According to Experian Automotive, 1 in 172 outstanding auto loans

In December 2022, the average new car loan rate was 8.0%, an increase from 5.15% the year prior. For subprime borrowers, the rate is typically higher. One individual interviewed had their 2013.

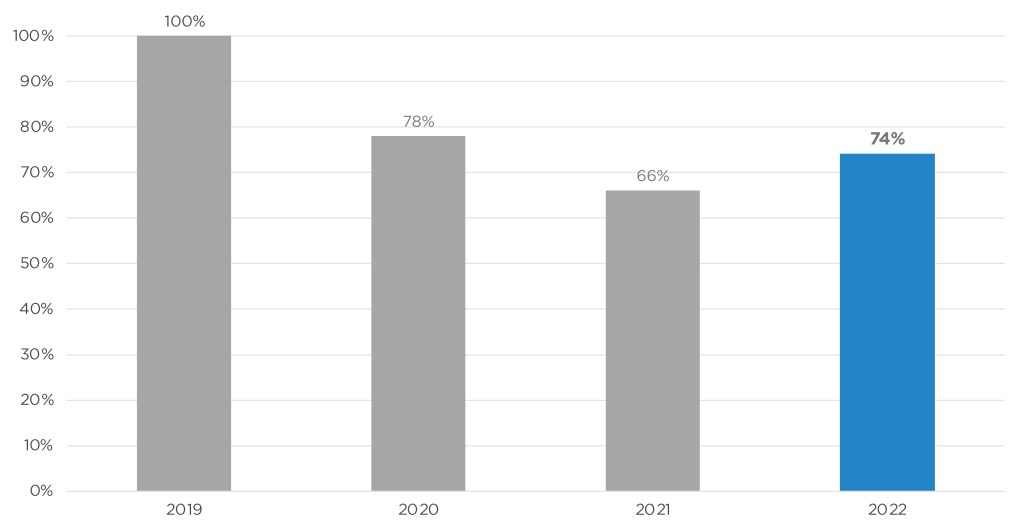

Land Registry UK Repossessions Data The Numbers Might Just Surprise You! House Buy Fast

The average monthly payment for a new car is up 3.6% since last year to $726 monthly. The average auto loan term is 68.3 months for new cars, 67.6 months for used cars, and 36.2 months for leased vehicles. Auto loans average almost $40,184 for new vehicles. Around 81.4 million individual American adults have a car loan.

Five Proactive Ways for Lenders to Reduce Repossession Rates

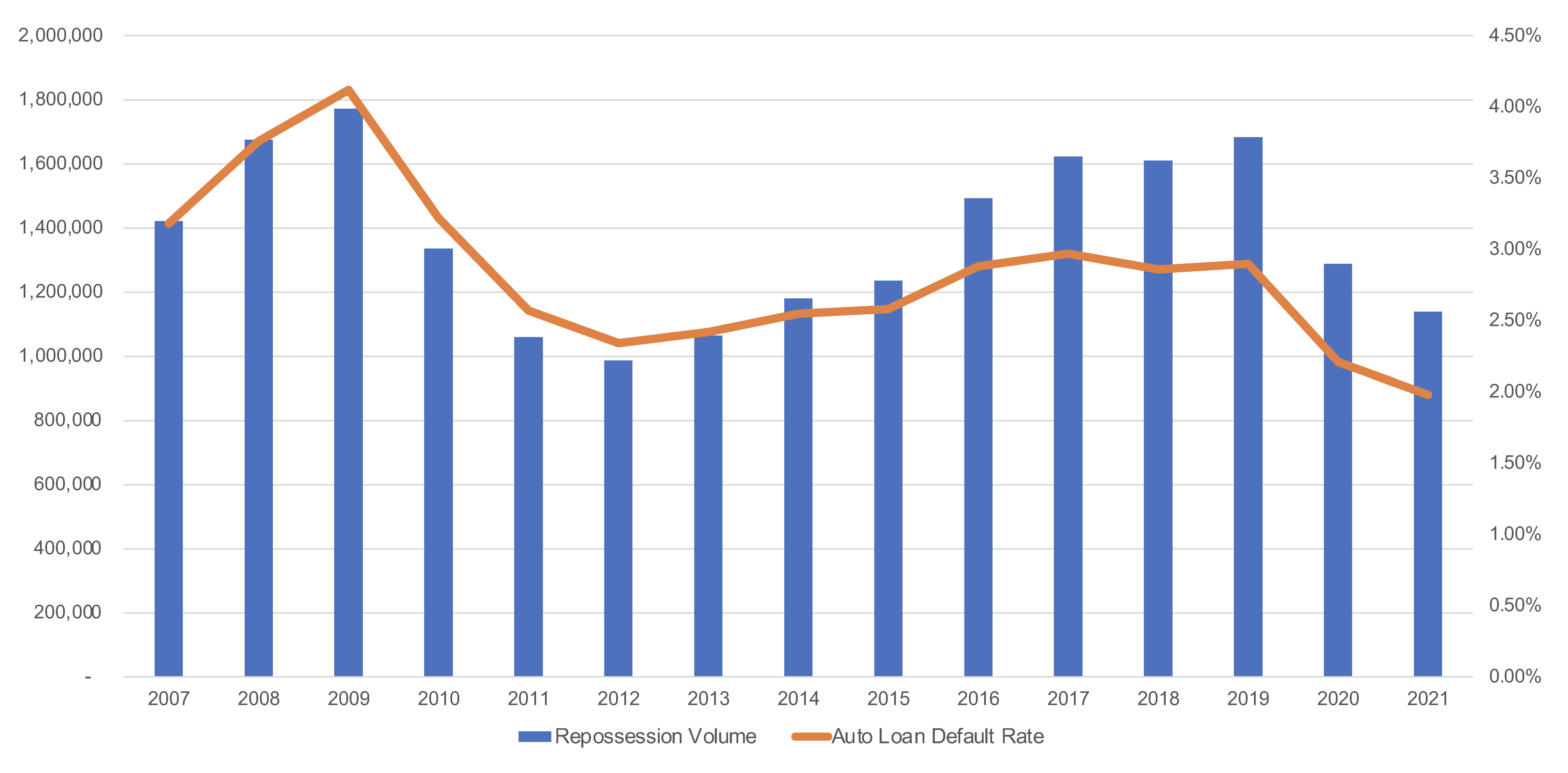

REPO CHECK-IN INDEX. Historical data reveals that auto loan defaults have generally been higher than repossession volumes, with around 20% of defaulted loans not resulting in repossession. Despite higher loan delinquency rates during 2022, the overall default rates in the year were still lower compared to 2019.

Auto Repossessions Are on the Rise, As People Walk Away From Car Loans MishTalk

Americans Fall Behind on Car Payments at Higher Rate Than in 2009. Automobile repossessions are climbing as inflation forces struggling consumers to make tough choices. This article is for.

60day delinquency rates for auto loans drop in Q2 Automotive News

According to data from A TTOM, a property analytics company, U.S. foreclosure filings totaled 95,712 in the first quarter of 2023. That's 6% higher than in the previous quarter and 22% higher than.

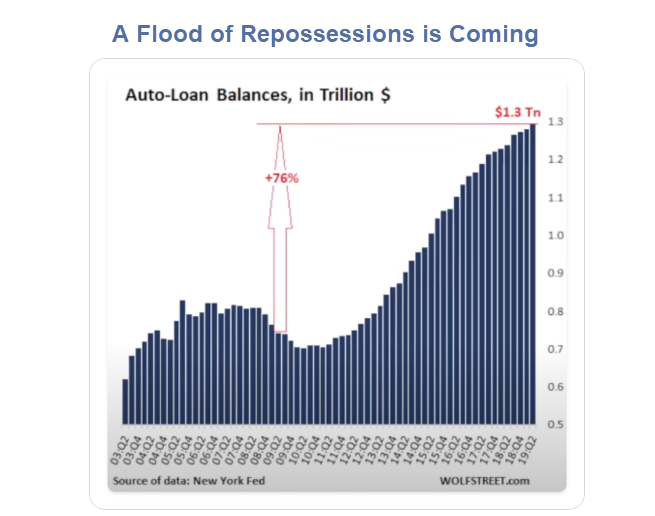

A Flood of Repossessed Cars Poised to Hit the Used Car Market MishTalk

According to Kelley Blue Book, the average price of a new vehicle rose 13.5% year over year to $47,148 in May. Combined with record-high monthly payments, it's easy to start piecing together the.

The Top 4 Ways Car Repossession Can Hurt Your Credit Score Ride Time

Cars are more expensive, interest rates are rising quickly, and together that equals record-high monthly auto payments. Over the past year, the average car payment has risen from $623/month to $733/month. Go back further in time, and the average car payment was $502 in 2017. When auto loan payments increase nearly 50% in just five years, lower.

Auto Loan Defaults Are Increasing, But We Are Not Heading Into A Repo Crisis Cox Automotive Inc.

Back in February, Cox Automotive indicated what we already intuitively knew: car repossessions are up, way up. After a sleepy time during the past couple of years, Cox found that nationwide the rate of vehicle repos had increased a whopping 20.4%. The bad news is it looks like this is only the beginning of a trend that continues to grow.

Repossessions are Down, Thanks to and Stimulus Cox Automotive Inc.

The average for a used vehicle was $532, up slightly from $530. The average interest rate on a loan for a new car was 7.18 percent at the end of 2023, up from 6.08 percent in 2022, Experian said.

How a Repossession Will Affect Your Future Auto Insurance Rates InsTrvl

The result has been a dramatic increase in the percentage of subprime borrowers falling at least 60 days past due on their auto loans. In January 2023, 5.93 percent of subprime borrowers were.

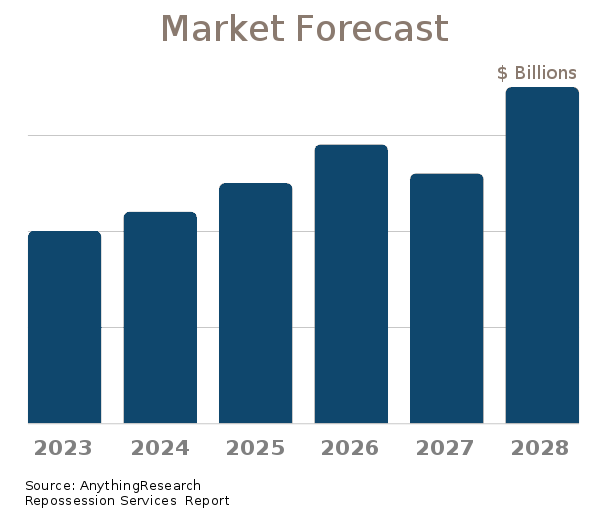

2023 Market Size, Forecast, & Repossession Services Industry Statistics Research Report

2022 delinquency rates continue to rise. The strong credit trends during the pandemic are returning to normal levels, exemplified by auto loan performance this month. According to Cox Automotive.