شبكة أفكار محمد عقل 13/6/2021 20/6/2021

WHY NON-RESIDENTS NEED CAR INSURANCE IN CANADA. Car insurance is a requirement for all drivers in Canada, regardless of residency status. This means that if you are a non-resident of Canada and plan to drive in the country, you are legally required to have car insurance. Failure to have coverage in Canada can lead to severe penalties and.

How to Get Cheap Car Insurance Rate in Canada

Pricing of Car Insurance for Foreigners in Canada. The cost of car insurance for non-residents in Canada is influenced by several factors, such as: The foreign driver's age. The foreign driver's insurance record. The foreign driver's driving experience. The location you're traveling to or relocating to. Given the individual nature of.

Does U.S. Car Insurance Cover You in Canada? Experian

Typically, your U.S. coverage will apply to a rental car driven in Canada, regardless of whether you picked it up in the U.S. or Canada. In fact, a rental car agency in the U.S. might even be able to provide the Yellow Card insurance ID Canadian authorities require. If you rent the car in Canada, you may be able to purchase coverage to.

Best Car Insurance Canada in currentyear l Comparison and Reviews

Non-residents can drive in Canada as long as they have the minimum requirements, which are a valid driver's license and car insurance. Depending on the Canadian province, and as long as you have a valid foreign driver's license, you can drive in Canada for up to three or six months without an international driver's permit or a Canadian.

Car Insurance Savings Canada vs USA CommonGroundNews

When you work with BrokerLink, we will be by your side every step of the way. You can reach us by phone, email, or in person at one of our many locations across Canada. You can also take advantage of our online quote tool and request a free car insurance quote now. Get an auto insurance quote 1-866-724-2372.

Important things to Note while purchasing Car Insurance ManipalBlog

Absolutely, but fortunately, your U.S. car insurance will cover you. Because of reciprocal laws between the two countries, Canada honors your U.S. insurance, and vice versa, in the event of an accident or claim and to meet insurance requirements. "Most standard personal auto policies automatically include Canada in the 'policy territory.

Car Insurance SMSH Auto

CCIR At: 5160 Yonge Street, P.O. Box 85, Toronto, Ontario, M2N 6L9 Tel: 416 590 8479 Fax: 416 226 7878 email. Buying a New Car. Buying a Used Car. Registration. Visitors & Non-Residents. Vehicle Insurance. Importing a Vehicle. Vehicles from the US. Countries Outside the US.

Car insurance canada image Insurdinary

Car insurance is legally required for all drivers in Canada. You need it in all provinces and territories if you want to drive. It's a serious offence to operate a vehicle without insurance. For example, driving without insurance in Ontario can result in fines ranging from $5,000 to $25,000 for the first offence.

Rental Car Insurance In Canada Save A Bundle With A Little Research creditcardGenius

Third-party liability coverage. This is the most basic and mandatory coverage required in Canada. It provides coverage for injuries or damages you may cause to other people or their property while operating your vehicle. The minimum liability coverage limits vary by province, but it generally starts at $200,000.

What’s the Average Car Insurance Cost for Canadians?

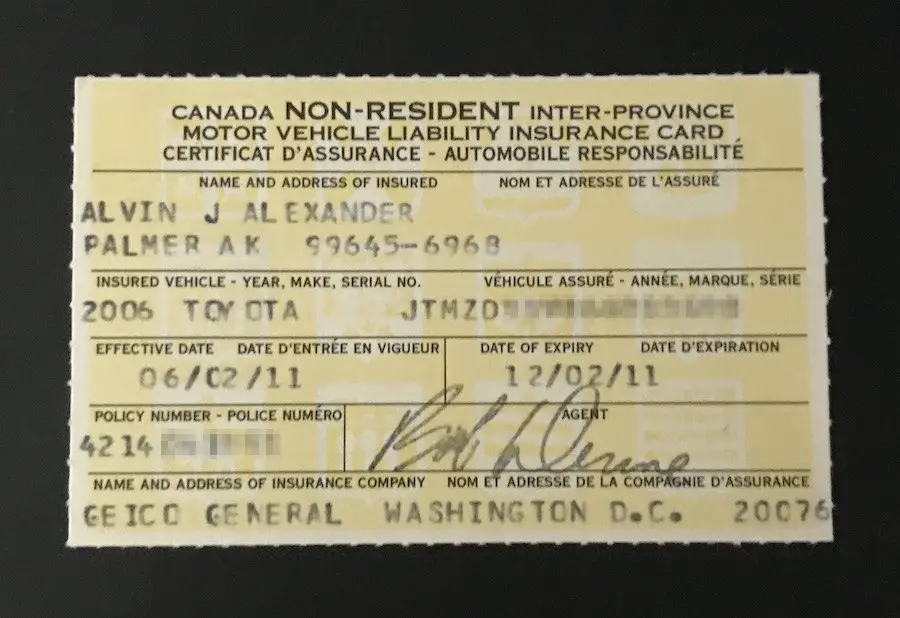

Information Regarding GEICO Insurance And Canada. If you are thinking of driving your car to Canada, rest assured that your GEICO insurance will still cover you. While we do not offer insurance to residents of Canada, GEICO's coverage in the United States does extend north of the border. Please read the following important information if you.

Car Insurance Quotes Ontario Canada Car Insurance Quotes

The Insurance Bureau of Canada ( IBC) requires drivers to have a limit of $200,000 of liability coverage in all provinces except for Quebec. In Quebec, the minimum liability limit is $50,000. If you choose to purchase a Canadian auto insurance policy with any of the coverages listed below, they function much as they do in the United States.

List Of Canadian Insurance Companies Toronto Car Insurance

On average, Canadian drivers spend $1,142 per year on car insurance. Drivers pay the most in British Columbia (where the average cost is $1,832 per year) and the least in Quebec ($717 per year.

My Canadian auto insurance

Non-owner car insurance is a type of coverage that protects you if you're driving a car you don't own. If you take your friend's car out for a ride and you get into an at-fault accident, their auto insurance might not cover all the damages and loss. Having a non-owner car insurance policy, however, can protect you from paying what would.

Allstate Car Insurance Canada Review (2020 Update) Complete Car

If you are traveling to Canada by car, whether in your vehicle or a rental car, your U.S. insurance will usually protect you with the same coverages and limits that you have at home. Car insurance in Canada for visitors from the U.S. is governed by reciprocal laws between the two countries. Most major insurance companies will cover you if you.

Car Insurance In Canada A Complete Guide

Car insurance is legally required in all Canadian provinces and territories. Drivers who get caught travelling without sufficient insurance can expect a fine ranging from $5,000 to $25,000. Getting caught driving without car insurance for a second time can lead to the following consequences: Fines ranging from $10,000 to $50,000.

Car Insurance Prices By State Average Cost Of Car Insurance (2018)

Minimum liability insurance coverage in Canada is higher than in many U.S. states. For example, Canada requires you to carry at least $200,000 (CAD) in liability coverage in every province except Quebec, where the amount is $50,000. 6. You may need to modify your liability limits before arriving in Canada to comply with local regulations.