Top 7 Mistakes That Rideshare Drivers Make At Tax Time — Stride Blog

As a rideshare driver, most of your work likely happens on the road. So being able to claim home office expenses is relatively unusual. Still, some drivers build up their own brands outside of Lyft, Uber, and other gig apps — sourcing passengers and maintaining independent businesses from home.

Uber Accounting Spreadsheet in Uber Driver Spreadsheet Fresh Taxi Accounts Spreadsheet — db

The Medicare tax rate is 1.45%, while Social Security is 6.2%. Together, that adds up to 7.65% in FICA taxes. Since you're self-employed, you'll be responsible for paying both the employer portion and the employee portion, which brings your total up to 15.3%. If Uber is your side hustle, you'll pay 15.3% in FICA taxes on your income from the.

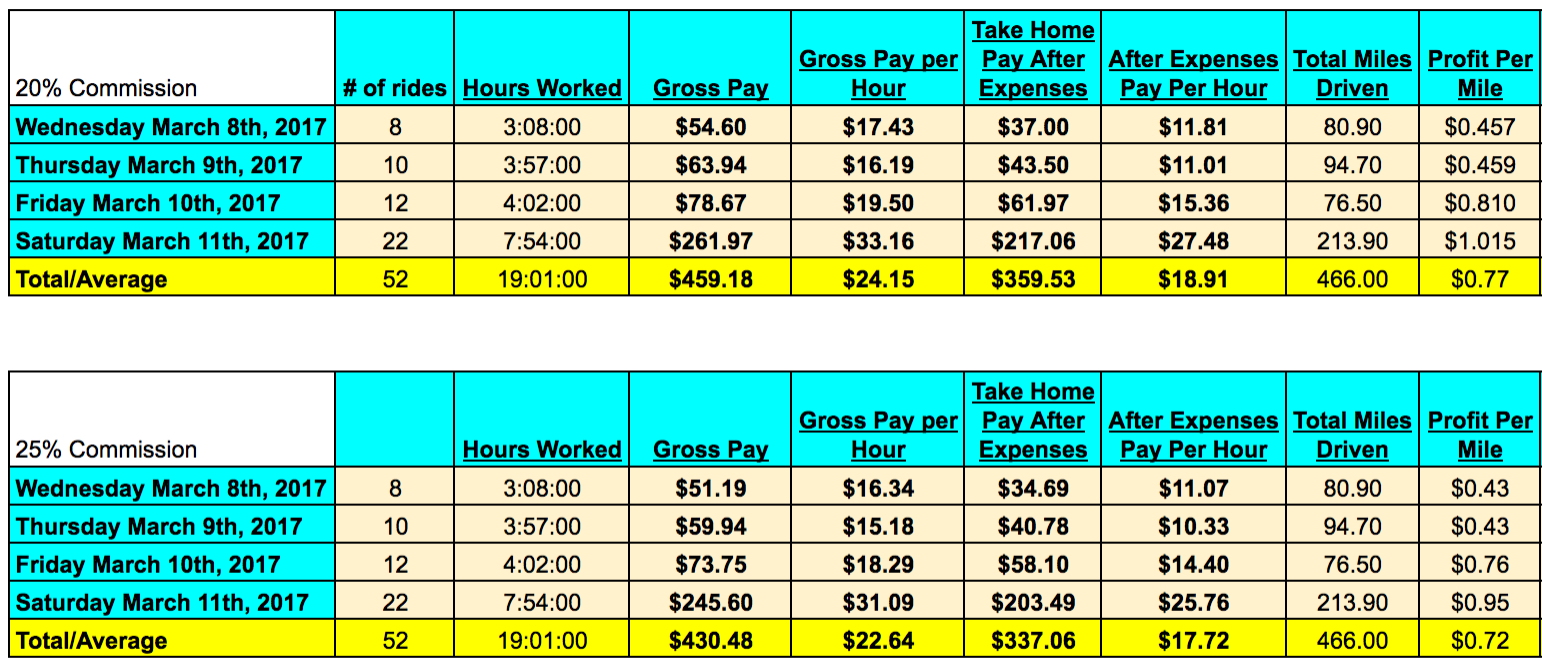

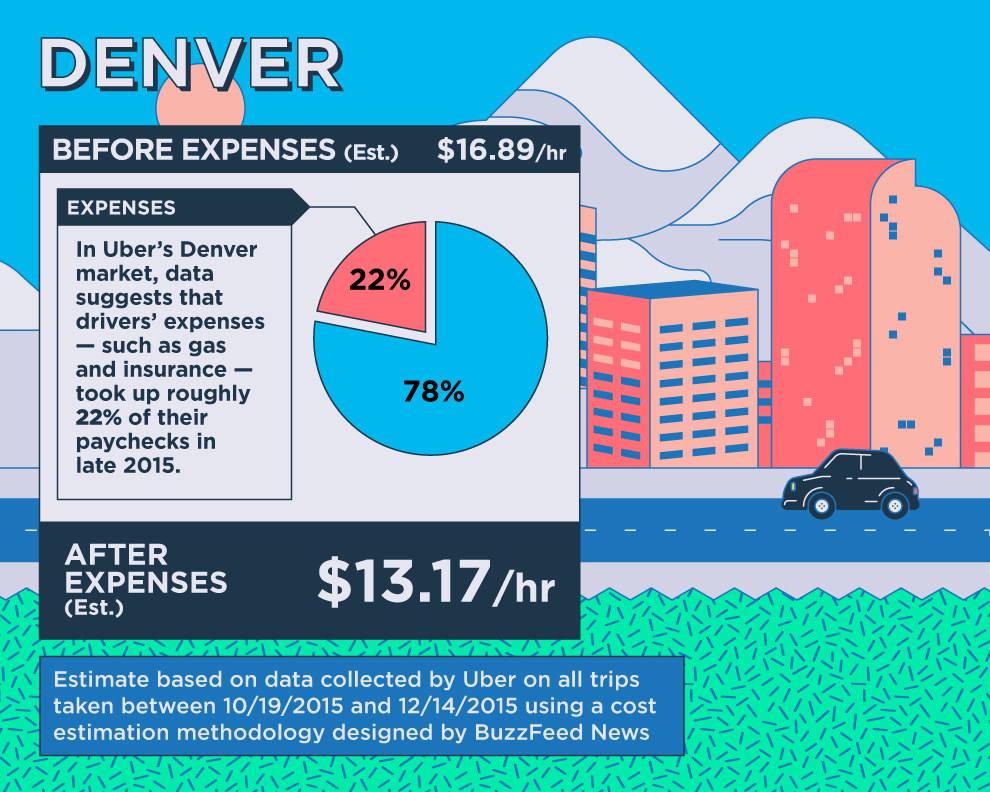

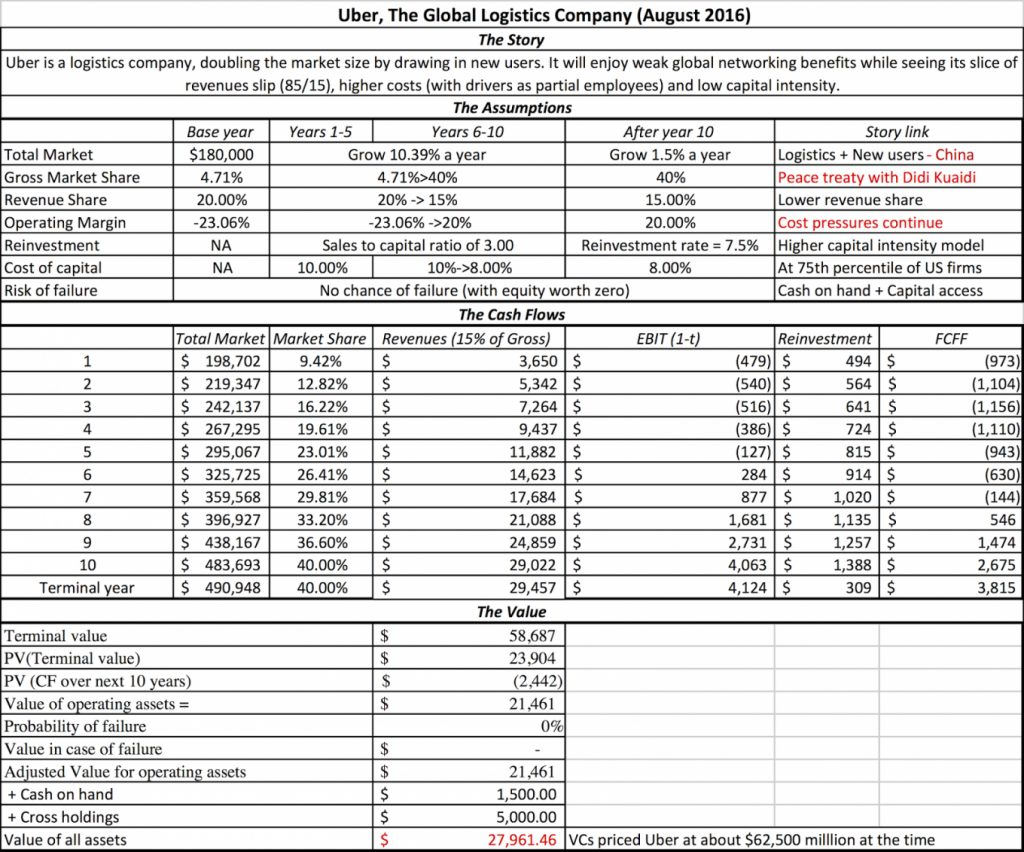

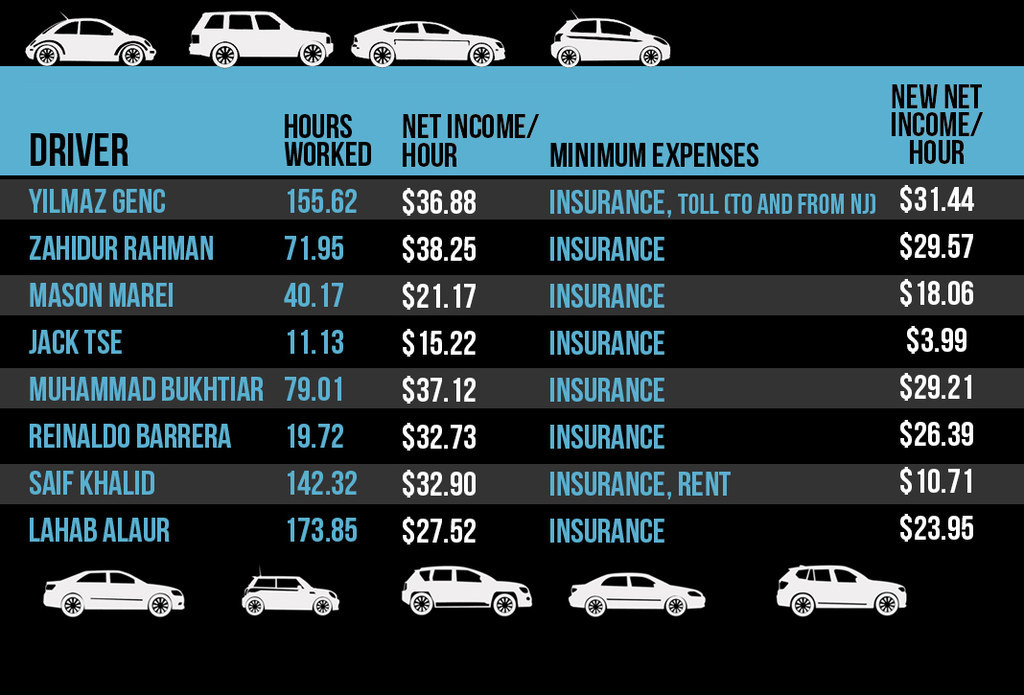

Uber Drivers Earn Less Than 10 Per Hour with Expenses, Survey Says Small Business Trends

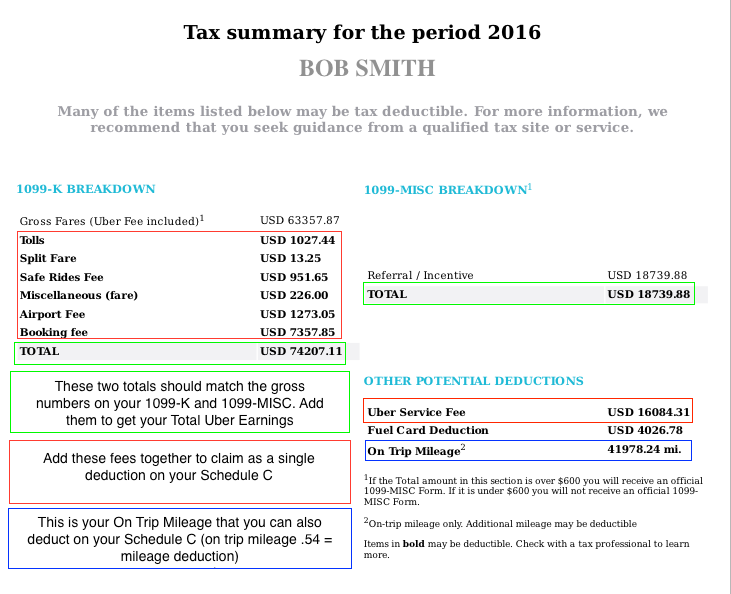

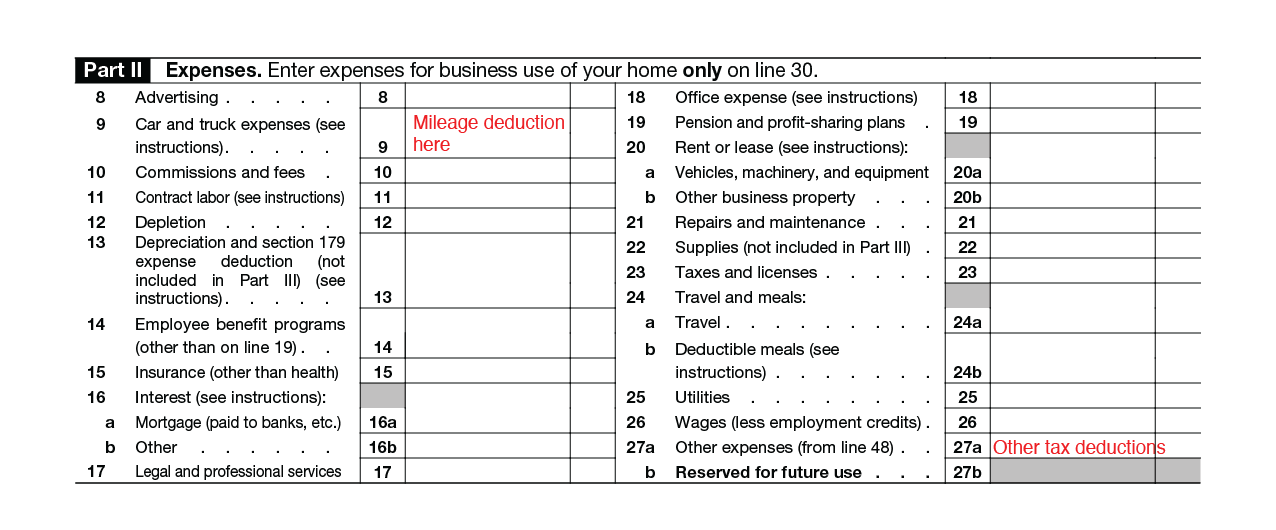

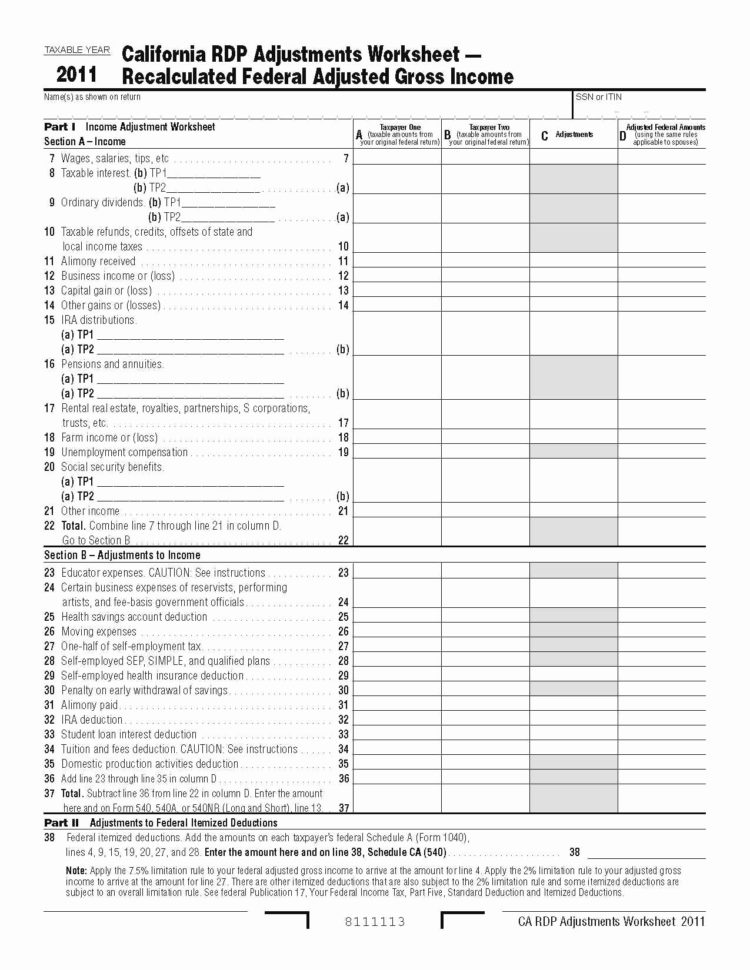

As an Uber driver, you incur many expenses, and most of them are deductible. Some common expenses that qualify as Uber tax deductions include: Business Related Insurance. If you purchase additional non-auto insurance for your business, this cost can be deductible. Cell Phone Bill. A portion of your cell phone bill is tax-deductible as an Uber.

Uber Driver Spreadsheet with Uber Driver Spreadsheet Spreadsheet Collections —

The largest tax deduction for most Uber drivers is the business use of a car. You can deduct the actual expenses of operating the vehicle or you can typically use the standard IRS mileage deduction. For 2023 the rate is 65.5 cents per mile. The rate increases to 67 cents per mile for 2024.

Spreadsheet For Uber Drivers Google Spreadshee drivetax bookkeeping spreadsheet for uber drivers

Tax deductions for rideshare drivers can include a mileage deduction. The IRS has a standard mileage rate (SMR) for the business use of your personal vehicle. In 2022, the standard rate is 58.5 cents per mile from January 1-June 30 and 62.5 cents per mile from July 1-December 31. These rates take into account market fluctuations.

Standard Mileage vs Actual Vehicle Expenses for Uber Drivers

An Uber driver, though, can theoretically turn the app off, grab a bite, and then start working again. So the meal wouldn't be deductible. Understanding meal write-offs. Rule of thumb: If eating on the job is not a requirement for employment, then it's not a legitimate business expense. That's why most meals aren't deductible for Uber drivers.

Tax Deductions for Rideshare (Uber and Lyft) Drivers Get It Back Tax Credits for People Who Work

Drivers can deduct expenses on refreshments and other goods if you offer them to your riders - like water, snacks, and phone chargers. You can also write off and deduct items to keep your vehicle clean and safe for riders, including: First aid kits. Roadside assistance plans. Jumper cables.

How Much Uber Drivers Actually Make Per Hour

Tax write-offs for Uber drivers: Business expenses. You can also deduct any other Uber-related business expenses you incurred. These may include: The cost of your cell phone. 100% deductible if you use it just for business, otherwise you can deduct the business use percentage. Water, candies, gum and other items you provide your passengers.

Uber Driver Spreadsheet —

The mileage deduction enables you to write off a set dollar amount for every mile that you drive for business purposes. For the 2022 tax year, you may write off $0.585 for every mile you drove as.

What Expenses Are Tax Deductible For Uber Drivers YouTube

For a $30,000 vehicle, the depreciation deduction alone could be $6,000. If you added in 50% of just gas and car insurance, that could be another $1,000 to $2,000. Most heavy drivers save more by claiming the standard mileage deduction. This includes full-time rideshare or delivery drivers who may drive 40 to 60 hours a week.

What Uber Drivers Really Make (According To Their Pay Stubs)

Food and drinks provided to your clients is deductible on your return. You can only deduct 50% of the cost. Your vehicle is your business and you need to keep it looking good. Car Washes would be considered an ordinary expense for your business. If you purchased a AAA or similar membership because of your business, it is considered an ordinary.

Uber driver salary is less than 10 hour for half of US Uber drivers Recode

/cdn.vox-cdn.com/uploads/chorus_asset/file/13201377/uber_ridester.png)

These expenses vary depending on each driver's vehicle. Some drivers use electric vehicles to reduce their gas and maintenance costs.. Wesley Johnson, a 64-year-old Uber driver who works.

Spreadsheet For Uber Drivers Google Spreadshee drivetax bookkeeping spreadsheet for uber drivers

Here ere are the most common tax deductions that Uber drivers can take: Mobile phone expenses, including billing and cost of the phone. Personal protective equipment (PPE), including masks, face shields, & hand sanitizers. Outside of these common business expenses, most Uber drivers find the biggest tax savings by deducting vehicle expenses.

Uber Driver Profit Spreadsheet Throughout Truck Driver Profit And Loss Statement Template

Feb 6, 2024, 11:17 AM PST. Dean Ceran works for Uber between 50 and 60 hours a week. Driving expenses significantly reduce his business profits. Dean Ceran. A boomer Uber driver's business had.

How Much Do Uber Drivers MakeShow Your Weekly Pay Stubs Payments, Taxes, Uber

Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings. Who gets it? We'll send you a 1099-K if: You earned more than $20,000 in customer payments in the last year and. Note: Certain states have implemented lower reporting thresholds.

Free Uber Spreadsheet Expense Tracker + ATO Logbook

However, when you're a rideshare driver (independent contractor), you are responsible for the entire amount, 15.3% of your taxable income (12.4% goes to Social Security and 2.9% to Medicare). However, self-employment income only applies to your net earnings or profit. This is your earnings after any expenses.