g wagon tax write off australia Shag Weblogs Photographic Exhibit

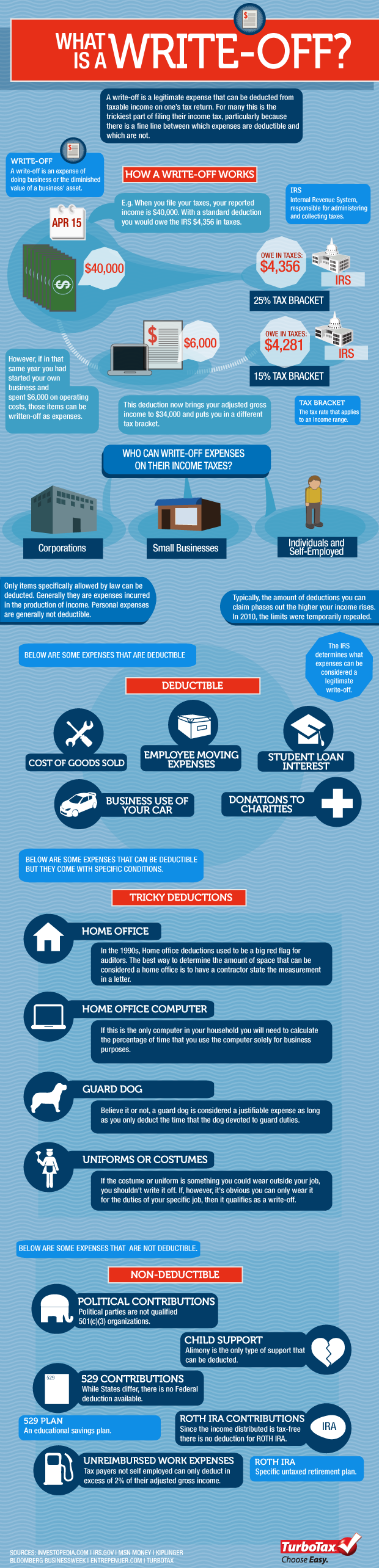

Its-a-write-off • 1 yr. ago. You'd have to pay depreciation recapture on anything above the straight line depreciation then. So there is no reason to 179 here. [deleted] • 1 yr. ago. If it's eligible for Section 179 you can 100% write off cost of it in year 1.

Taxes For Endowments How It Works Tabitomo

How to WRITE OFF a G-WAGON! #taxdeductions #gwagon #tax. Most relevant. Author. David A. Perez. Bryan Ezell I would agree. 45w. Timothy Hero. IRS Section 179 depreciation deduction: Up to $25,000 of the cost of vehicles rated between 6,000 lbs GVWR and 14,000 lbs GVWR can be deducted using a section 179 deduction

g wagon tax write off explained Have Severe Blogs Photo Gallery

Ford 150 tax write off. Cadillac escalade tax write off. This ones also known as the g wagon. You can find this using hmrc's company car and car fuel benefit calculator. Seems like it would be a good way to get cars for less than usual. Source: www.smartmotorguide.com

G Wagon Tax Write Off Weight Vehicles That Qualify For 6000 Lb Tax

️ Stock Portfolio + Tracker https://patreon.com/humphreytalks🐪 My Free Newsletter https://humpdays.substack.com👾 Join the Discord Community https://.

g wagon tax write off explained Regine Guest

The deduction limit in 2021 is $1,050,000. For example, let's say you spent $20,000 on a new car for your business in June 2021. You use the car for business purposes 75% of the time. If you were to claim the Section 179 deduction, you could take a $15,000 deduction ($20,000 × 0.75) on your 2021 tax return, which you'd file in early 2022.

g wagon tax write off explained Regine Guest

Thanks to Section 179, you can enjoy a tax write-off on the efficient yet heavy-duty vehicle you need to earn a living. Fortunately, you needn't look any further than the Mercedes-Benz lineup for the ideal addition to your business. Plenty of Mercedes-Benz SUVs meet Section 179's 6,000-to 14,000-pound GVWR requirement.

g wagon tax write off explained Regine Guest

According to marketrealist.com they say that G-Wagons can be tax write offs because it weighs more than 6,000 pounds. Yeah, you read that right, 6k is the minimum a car has to weigh to be considered for tax write off benefits. If your car qualifies them it'll be able to deduct up to $25,000 from the taxes owed.

g wagon tax write off explained Regine Guest

Under Section 179, the IRS allows the owner to write off the vehicle over the course of 5 years. However, if you take advantage of section 179 and bonus depreciation, you can deduct the entire value of the vehicle in just one year.

g wagon tax write off explained Un Toney

As far as I understand: section 179 is subject to recapture, bonus depreciation is not. Section 179 requires profit in the business, bonus depreciation does not. Possible, by the letter of the law, you could buy a vehicle December 31st, use it 100% business use that year and claim bonus depreciation. January first it could transition to.

Mercedes G Wagon Tax Write Off 20222023

Total Write off $12,000 Plus $30,000= $42,000 Purchase Example & Calculations: If you purchase the G Wagon for $200,000 and put down $50,000 and finance the remaining over 60 months the calculations will work the following way assuming 100% business use:

g wagon tax write off explained Suitably Blogs Image Database

Section 179 is a way to write of part of the allowable basis (generally the purchase price) of a business asset, something owned by a business such as a car or machine. The maximum Section 179 deduction for taxpayers across all businesses is limited to $1,080,000.00 for taxes beginning in 2022. The maximum Section 179 deduction for tax years.

Mercedes G Wagon Tax Write Off 20222023

Learn the rich's tax secrets with my new book! Click the link belowhttps://ebook.taxalchemy.comTaking the Next Step: 📞 Book a Professional Tax Strategy Cons.

g wagon tax write off explained Have Severe Blogs Photo Gallery

The IRS allows a vehicle to be written off over the course of 5 years. But you can make use of section 179 and bonus depreciation to completely write-off the vehicle value in one year. According to the IRS, section 179 allows depreciation of business vehicles (also personal vehicles if used partially for business) based on vehicle weight.

g wagon tax write off explained Un Toney

In this post, we're going to show you 8 cars that you can write off 100% using the vehicle tax deduction and section 179 deduction. Before we dive into the list, let us quickly explain what the vehicle tax deduction is. What is Vehicle Tax Deduction?

g wagon tax write off uk Masterfully Diary Picture Show

November 10, 2022 Share post: G Wagon Tax Write Off California Getting a G-Wagon for 50% Off Using the Tax Code? California has very specific rules pertaining to depreciation and limits any Section 179 to $25,000 Maximum per year. So for example, if you purchase a vehicle for $125,000,

g wagon tax write off explained Have Severe Blogs Photo Gallery

What Is the G-Wagon Tax Write-Off and Who Can Claim It? Home > Personal Finance Can You Still Claim the Viral G-Wagon Tax Write-Off? With a gross vehicle weight of more than 6,000 pounds, the.