Mechanical Breakdown Insurance VS Extended Warranty

Mechanical Breakdown Insurance. Eligible Vehicles: With MBI, eligible vehicles include used cars with mileage less than 15,000 miles. Coverage Limit: Coverage limits for MBI is for seven years or.

State Farm Mechanical Breakdown Insurance Worth It? (2022)

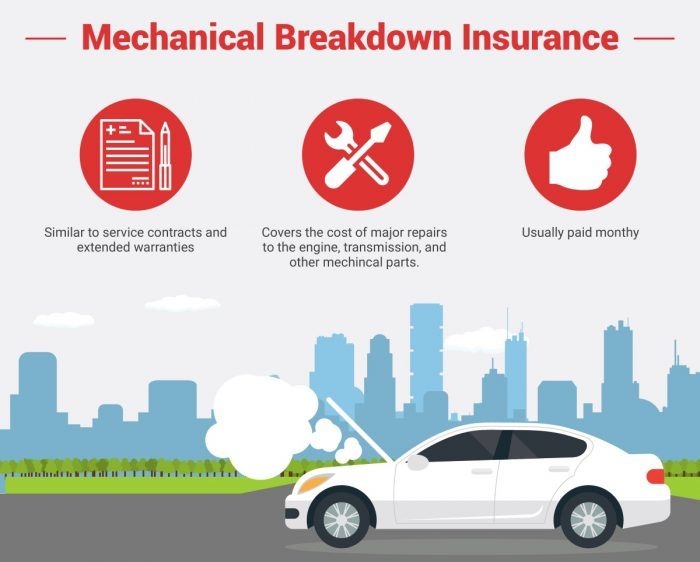

Mechanical breakdown or car repair insurance is a way of adding an extra layer of protection to your auto insurance policy. Similar to a car warranty, this type of insurance covers costs from repairs if your vehicle breaks down, needs replacement parts, or suffers other types of mechanical problems.

Mechanical Breakdown Insurance Fine Print Endurance Warranty

Mechanical Breakdown Insurance, or MBI, is one of the more straight-forwardly named products in the extended warranty field. It's quite literally an insurance policy that provides coverage if your vehicle suffers a mechanical breakdown of a covered part. That means if your transmission conks out, and it's covered by an MBI policy, you won.

mechanicalbreakdownautorepairinsurance Just Van Life

Mechanical breakdown insurance (MBI) is an insurance coverage you can get as a stand-alone policy or added on to your existing car insurance policy. MBI typically doesn't cover standard wear and tear or routine maintenance, but it will cover mechanical failure. While new cars may come with manufacturer warranties that cover mechanical defects.

Mechanical Breakdown Insurance Vs. Extended Warranty (2022)

Mechanical breakdown insurance is an optional type of insurance that provides coverage for the major systems in your car, like the engine and transmission, which are not covered by standard car insurance policies. Mechanical breakdown insurance (MBI) is similar to an extended warranty but provides more coverage.

What does Mechanical Breakdown Insurance cover? SP Insurance

If you want coverage for mechanical problems, consider car repair insurance, commonly known as "mechanical breakdown insurance." This pays for repairs if your car has mechanical or.

All the Different Types of Car Insurance Coverage & Policies Explained

Mechanical breakdown insurance (MBI) is a type of insurance policy that covers the repairs or replacements of certain vehicle parts after they break down. Unlike standard car insurance,.

What's The Difference Between Mechanical Breakdown Insurance And An

GEICO mechanical breakdown insurance can cover your vehicle for up to 7 years or 100,000 miles, whichever comes first. It is an optional policy that isn't to be confused with typical car.

Auto Mechanical Breakdown Insurance Hayes Company Insurance Brokers

Mechanical breakdown insurance is an optional coverage that provides protection for repairs not typically covered by standard car insurance. Auto Auto Warranty Best Extended Auto Warranty.

Auto Insurance vs. Mechanical Breakdown Coverage autopom!

Is mechanical breakdown insurance worth it? Compare mechanical breakdown insurance and extended car warranties to decide which is right for you. Overview Top Picks Cost Coverage More ZIP.

Mechanical Breakdown Insurance Everything You Need to Know WalletGenius

Mechanical breakdown insurance (or MBI) is really just " car repair insurance. " While you typically have to buy MBI before the factory warranty runs out, it normally extends beyond the coverage offered by that warranty. However, it doesn't cover repairs caused by accidents. Premiums for MBI are "calculated based on the term of the.

Mechanical Breakdown Insurance YouTube

Mechanical breakdown insurance, also known as MBI, helps pay repair costs for major mechanical problems not caused by a car accident or normal wear and tear. It's optional coverage that you.

Mechanical Breakdown Insurance 101

Mechanical breakdown insurance, also called car repair insurance, is a type of insurance policy or an endorsement to your auto insurance policy that helps cover the cost of mechanical.

Mechanical Breakdown Insurance

Mechanical breakdown insurance fills the gaps left by extended car warranties. If you recently bought a new car but you only selected a basic or mid-level extended warranty package, mechanical breakdown insurance can protect your investment. Supplementing an extended warranty with mechanical breakdown insurance may also help you secure lower rates.

Mechanical Breakdown Insurance What Is It And Do I Need It? Cover

Mechanical Breakdown Insurance vs. Extended Warranties.. It's worth pointing out that not all vehicles will qualify for this specialized coverage. Most older cars won't qualify for this type of insurance. So if you have an aging vehicle or high mileage vehicle, then you likely won't be able to tap into this insurance policy option..

Mechanical Breakdown Insurance Bankrate

Is mechanical breakdown insurance worth it? Ultimately, purchasing mechanical breakdown insurance is a personal decision. It may be worth it for some and not for others.