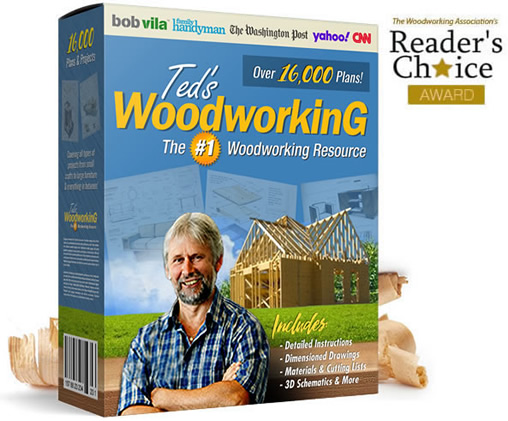

Nebraska Insurance Coverage Continuation Form Fill Out, Sign Online

Driving without proper insurance can result in three points being added to your record. A driver in North Carolina can have their license suspended if they accumulate 12 points in a three-year period. If it is the first time the license has been suspended, the suspension will last for 60 days. The second suspension will last for six months, and.

Business Operations Management & Customer Service One Health Direct

North Carolina law requires that every registered vehicle must have continuous liability insurance coverage provided by a company licensed to do business in the state. State law requires these minimum liability insurance coverage amounts: $30,000 for bodily injury (one person) $60,000 for bodily injury (2 or more people) $25,000 property damage

What happens if your Car Insurance Lapses Money Clinic

Collapse All If I feel the termination of insurance is unjustified, do I have any recourse? Yes, if you believe the lapse in coverage was not due to any fault or neglect on your behalf and your license plate has been revoked you may request an administrative hearing. Call the NCDMV Customer Contact Center at 919-715-7000 for more information.

CJ Reports Stunning veto override could put Medicaid transformation

Insurance policy from a North Carolina-licensed insurer that shows when the policy was issued and when it expires North Carolina Certificate of Insurance (FS-1) showing the vehicle year, make, model and vehicle identification number DL-123 insurance form (provided by a North Carolina insurance company) Learn More

Insurance Term of the Day Lapse of Coverage ICA Agency Alliance, Inc.

This will help you avoid a civil penalty of $50.00, $100.00, or $150.00 depending on how many prior paid lapses you've had within a three year period (GS 20-311) for failure to maintain continuous insurance coverage. North Carolina law requires you to have liability coverage in effect on your vehicle during the entire time it is registered.

Does a Lapse in Coverage Affect Your Car Insurance Rates? Bankrate

Car Insurance Lapse & Grace Periods Explained | Progressive Log In Has your car insurance lapsed? Find out what to do when your auto policy lapses and understand the consequences of not carrying car insurance.

Continuous Home Inspection Coverage and Retroactive Coverage

Liability Insurance Pay Liability Insurance Lapse Fee You can now pay a Liability Insurance Lapse Fee quickly and easily on myNCDMV. Follow the steps below to get started: 1. Sign in to myNCDMV or continue as a guest. Then select Pay Citizen Liability Insurance Lapse.

Homeowners Insurance Lapse What Happens If There's a Gap in Coverage

A lapse in car insurance coverage will almost always result in a premium increase when you reinstate your coverage. You must surrender your license plates in North Carolina if your insurance has lapsed. You must show proof of insurance and pay the required fees to get your license plates back in North Carolina.

Points to remember for lapsed insurance policy

1. Sign in to myNCDMV or continue as a guest. Then select Pay Citizen Liability Insurance Lapse. 2. Next, search for the vehicle by entering the Plate Number, Control Number, and/or the last 5 digits of the Title Number. 3. Review the vehicle details by clicking the blue arrow on the Additional Information line.

You Cannot Afford An Auto Insurance Policy Lapse CASH 1 Blog News

NC DMV requires all drivers to maintain continuous insurance coverage and will suspend a driver's registration for at least 30 days if there is an insurance lapse. To get the registration back, drivers must provide proof of insurance and pay a $50 restoration fee.

What Does It Mean To Have a Lapse In Insurance Coverage? YouTube

Consequences of having a lapse in car insurance coverage in North Carolina can be quite severe. First, you will receive a ticket and a fine for driving without insurance. If you are caught without insurance, your driver's license and car registration could be suspended, and you will also be required to pay a $50 penalty fee.

What Happens If Your Car Insurance Lapses In Nc Car Retro

Updated on: Dec 01, 2023 Editorial Integrity Lapse in coverage: Penalties by state and how much insurance goes up A 30-day lapse in coverage makes your insurance rates go up by 14%, based on a 2022 CarInsurance.com rate analysis. Know how each state handles coverage lapses and what penalties they impose. Skip to article Written by: Shivani Gite

Don't Let This Happen Local League Insurance Lapse Breaks Budget

Accidents Caused by Underinsured Drivers in N.C. While motorists may purchase varying amounts of vehicle liability insurance, North Carolina law requires vehicle owners to have at least the following mandatory minimum insurance levels: Bodily Injury: $30,000 for one person, $60,000 for two or more people; Property Damage: $25,000.

Lapsed Life Insurance Coverage Things to Know Gianelli & Morris

Minimum Coverage. North Carolina law (G.S. 20-279.21) also requires insurance coverage for uninsured/underinsured motorists, as well as minimum bodily injury and property damage limits. This is required for all policies, even if they exceed the minimum requirements.. Call NCDMV at (919) 715-7000 to confirm that the insurance lapse has been.

3 Smart Tips For Maximizing Your Health Insurance Coverage

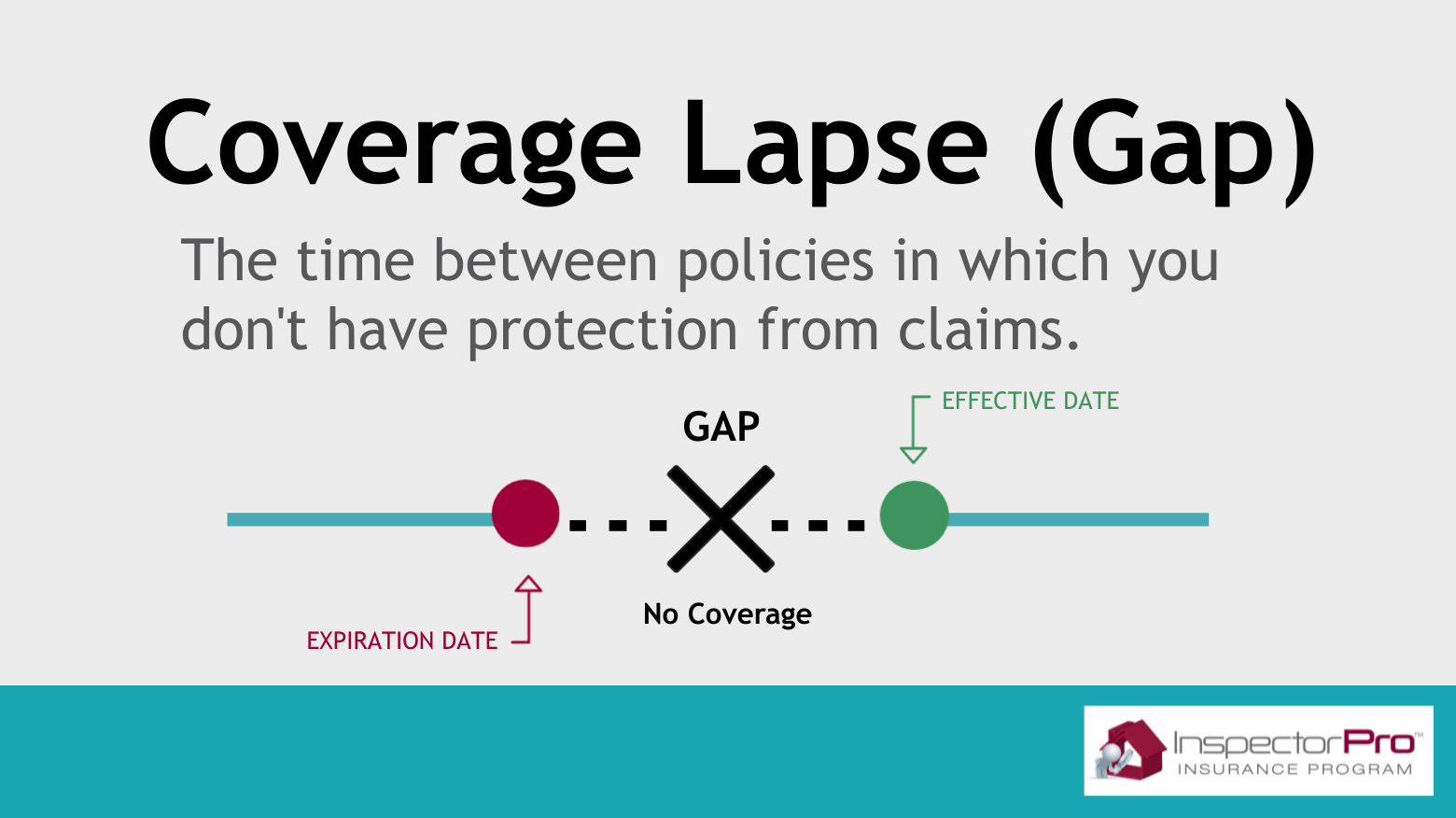

Are you aware of the potential implications of an insurance lapse in North Carolina? Whether it's due to forgetfulness or financial constraints, letting your insurance coverage lapse can have significant consequences. In this article, we will delve into the world of insurance lapses, specifically focusing on North Carolina, and provide you.

Insurance Coverage RoyaltyFree Stock Image Storyblocks

A lapse in your insurance coverage happens when there's a period of time between when your vehicle is insured and when it is not. What causes a lapse? Failure to pay your insurance premiums Late payments beyond any grace period the insurance company allows Failure to renew your insurance policy Excessive traffic violations