Lyft Driver Review Can You Make Money Driving Others?

Insurance and required documents. Insurance coverage while driving with Lyft. Lyft's proof of insurance. California occupational accident insurance. How to update driver documents. Driving history requirements.

Lyft Insurance a Lyft and Uber a Lyft and Uber Driver

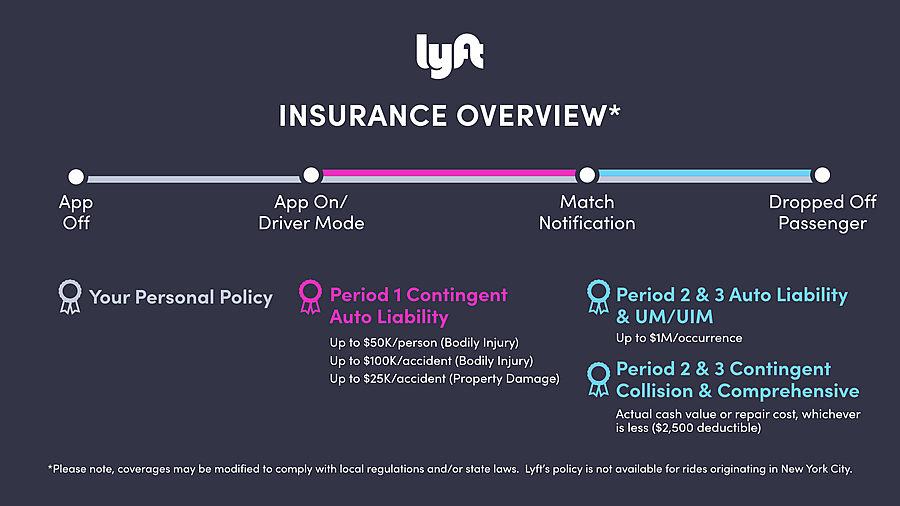

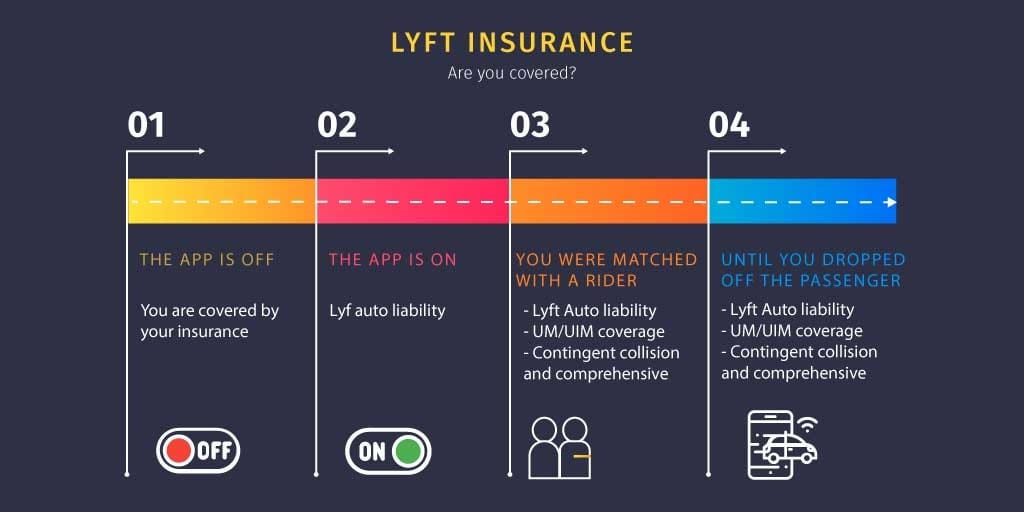

Period 0: This is when the driver is not using a rideshare app.This could include trips such as going to the doctor's office or the grocery store. Period 1: This period begins when an Uber or Lyft driver is using their personal car — with the app active — but has not yet received a pick-up request.Here, you would be covered by rideshare insurance and Uber's and Lyft' insurance coverage.

Lyft is Officially Launched in Canada Canada Startup & Tech News

In most states, Progressive rideshare insurance covers drivers who operate on delivery service platforms like Uber Eats or Door Dash. The exact coverages that apply between your personal auto policy with rideshare insurance and any insurance provided through the delivery company may vary by state. Call 1-855-347-3939 for more information.

Lyft Insurance Requirements For Michigan Michigan Auto Law

Lyft Insurance Protection Plan. Our first-of-its-kind insurance plan provides drivers with additional coverages, from the moment they flip into driver mode until their last passenger of the day is dropped off. Our $1M liability policy will apply as primary to a driver's personal automobile insurance policy when matched with a passenger.

Lyft Driver Requirements Do You Qualify to Drive in 2023?

Uber and Lyft driver insurance provide bodily injury liability coverage of $50,000 per person and $100,000 per accident, plus $25,000 in property damage coverage. This only applies if the driver.

How Do I See My Lyft Driver Reviews Pearce Shost1936

One of our readers reported that USAA's rideshare addendum cost them an extra $16 per month. For some drivers, it's as low as $6. Another reader and Uber driver reported that her total 6-month cost to insure a 2015 Nissan Sentra through USAA came to just $385 - including the rideshare add-on.

Lyft announces new changes to driver earnings statement. The new Lyft driver earnings statement

Insurance with Express Drive. If you've been involved in an accident or collision, please contact us as soon as possible. Express Drive is a rental program available for drivers in eligible regions. Coverage is classified based on the status (or 'period') you're in when the incident occurs: Waiting for a request: When the app is in driver.

What are the top questions every new Lyft Driver asks? The Lyft Driver Blog

Lyft's insurance coverage is at its maximum while the passenger is in the car. This coverage includes all coverage available in period 2 plus additional coverage for the passenger and the driver's vehicle. This includes the $1,000,000 third-party liability coverage, the UM/UIM, and the PIP coverage. The extra here is the Medical payments.

Unable to Rate on Lyft Uber Drivers Forum

Becoming a Lyft driver can help you generate more income. However, without enough insurance coverage, you could spend unnecessary money while driving for this rideshare service. While Lyft offers liability insurance and contingent comprehensive and collision coverage, these policies can leave coverage gaps that increase your financial risk.

Uber and Lyft Coverage One Endorsement Away NRG Insurance Student loans, Paying off

Hit and runs are covered by this insurance. Limit: $1,000,000 total bodily injury coverage. This coverage provides collision and comprehensive to your vehicle if and only if you have the coverage already. With this coverage, your deductible is set at $1,000, regardless of your personal policy's deductible.

In order to make sense of the best insurance coverages for you as a Lyft driver, you’ll want to

5. Primary Liability. Lyft insurance has two liability coverage options, depending on the phase you're in on the app. If you're active on the app but haven't accepted a ride, you'll get minimal liability coverage, $50,000 per person in bodily injury/$100,000 max per accident, and $25,000 property damage.

How Much Do Lyft Drivers Make In 2022? (2022)

Getty. If you have a work gig driving for a company like Uber or Lyft, rideshare insurance can provide critical coverage if you get into a car accident. While rideshare companies offer some.

Liberty Mutual providing Lyft driver rideshare cover Business Insurance

Lyft maintains the following insurance for covered accidents: At least $1,000,000 for third-party auto liability. First party coverages, which may include uninsured motorist coverage, underinsured motorist coverage, PIP, MedPay, and/or Occupational Accident coverage. If a driver obtains comprehensive and collision on their personal auto policy.

Lyft users can now search, reserve, and pay for parking spaces from the app in cities across the US

Here's an overview of Lyft's insurance policies: During Period 1: Liability limits are low; comprehensive and collision coverage aren't offered. Lyft's liability coverage has limits of $50,000 per person bodily injury, up to $100,000 per incident and $25,000 for property damage coverage. This protection is considerably less than the $100,000.

Lyft Insurance Ontario Car Insurance Endorsement BLOG OTOMOTIF KEREN / Are you and landlord

If your state's requirements are higher, Lyft matches that number. They both differ in their deductibles for the latter two periods. Uber has a $1000 deductible for comprehensive and collision.

Free Lyft Driver Bonus Tips APK for Android Download

When you're an active driver for Lyft and in the middle of a pickup or dropoff, Lyft's third-party liability insurance is the primary coverage. Lyft provides its drivers with coverage up to $1,00,000 per accident. In liability coverage, Lyft limits its coverage to the following limits: $50,000/person for bodily injury